Ex China reserves and resources of rare earth elements

- Minerals of critical concern

- China's attitude

- Interactive Map of Australia's JORC REE deposits

- Relative abundance Heavy - Light REEs selected deposits

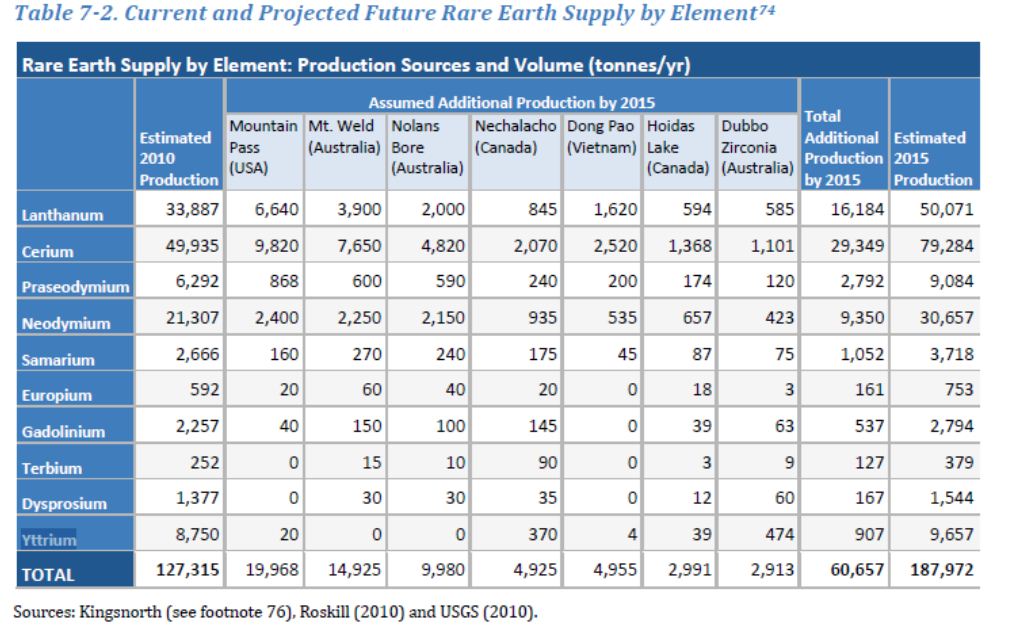

- Current and future supplies

- Difficult to Substitute For

World Rare Earth Elements deposits by Country ex-China

Unclassified resources not included.

Kvanefjeld, Nechalacho, Strange Lake and Dubbo have >10% heavy REOs (see below)

2014 Update

"It should be noted, however, that the most advanced REE projects other than Mountain Pass, California, namely Mount Weld and Dubbo in Australia, have required years of metallurgical testing and development" http://geology.com/usgs/developing-a-rare-earth-elements-mine/

"United States domestic reserves and inferred resources of REE are approximately 1.8 million tons, which are large compared with peak domestic consumption of REE of 10,200 tons in 2007 (U.S. Geological Survey, 2010). How much of that reserve and resource will be economically available, when, and at what rate, cannot be addressed with the data at hand. It can be said that the reserves and inferred resources reported in table 10 are of light REE and that these two potential mines may not be able to meet domestic needs for heavy REE with the production plans currently (2010) proposed. The pipeline of new REE projects within the United States is rather thin, with 10 out of 150 REE exploration projects identified worldwide. If we extend our analysis to reliable trading partners, such as Australia and Canada, prospects for diversifying supply and meeting future demand are considerably improved. Unfortunately, the time required for development of new REE mines is on the order of at least a decade, perhaps much longer in the United States, and forecasting future supply that far into the future is hazardous." USGS 2010 Rare Earths report. Long, K.R., Van Gosen, B.S., Foley, N.K., and Cordier, Daniel, 2010, The principal rare earth elements deposits of the United States—A summary of domestic deposits and a global perspective: U.S. Geological Survey Scientific Investigations Report 2010–5220, 96 p. Available at http://pubs.usgs.gov/sir/2010/5220/.

Critique of the USGS 2010 Report by USMAA

The United States Magnetic Materials Association (USMMA), a trade association representing domestic high performance magnet producers and suppliers, today applauded the recent U.S. Geological Survey (USGS) assessment, "The Principal Rare Earth Elements Deposits of the United States" as an excellent review of mineralization occurrences in the United States. While acknowledging that many such deposits are unproven and that China currently produces nearly all REEs on the world market, this report is the most comprehensive U.S. Government assessment of domestic rare earth reserves to date. It is thus a useful starting point for discussing options for developing reliable supplies of the raw and processed materials that are essential to national security and green technologies.

In its 2008 Minerals Yearbook, USGS cites U.S. imports of REE material at over 20,000 tons. Thus, based on USGS' own data, the United States runs a material shortfall of about 10,000 tons annually -- a shortfall which carries over from year to year. This figure from 2008 does not consider rapidly increasing domestic demand associated with REE-dependent "green technologies" like hybrid electric vehicles, nickel-metal hydride batteries, and wind turbines, which stands to further exacerbate the existing U.S. supply shortage. The press release accompanying the report states that domestic deposits have the potential to meet U.S. demand but fails to clarify that many of these deposits are not economically viable, potentially creating a false sense of security. The press release also fails to highlight the current global shortfall noted in the 2008 Minerals Yearbook, which stated, "Existing production is currently not sufficient to meet world demand, and shortages exist for neodymium and dysprosium for magnet alloys and europium and terbium for phosphors. Although the Mountain Pass deposit in the United States contains sufficient resources to meet domestic demand for light-group REEs, the deposit does not contain sufficient heavy-group REEs to meet demand for those elements." New supply sources -- which come on line in the next 1-4 years -- may ease this demand over time but cannot solve this significant, growing shortfall in the near term. The USMMA urges policy makers to pursue a "manufacturing first" solution that supports reliable, domestic production of neodymium iron boron magnets (the most pressing U.S. rare earth vulnerability) and other value added rare earth materials through existing tools, like the Defense Production Act. Such a step would provide increased demand for new sources of rare earth oxides and ensure their long-term viability while freeing us from our current dependence on Chinese sources of supply. The most pressing supply risk in the United States is our current limited capability to convert rare earth oxide to metals, alloys and powders, as well as the capability to manufacture rare earth magnets. USMMA members are working collectively to revitalize these critical, value-added capabilities. More information can be found at http://www.usmagnetmaterials.com.

Not all Rare Earths are Equal

According to many commentators and experts in the Rare Earths the heavy rare earths (neodymium, samarium, praseodymium, dysprosium and terbium) that are used for powerful magnets will be the first to be in a supply to demand imbalance.

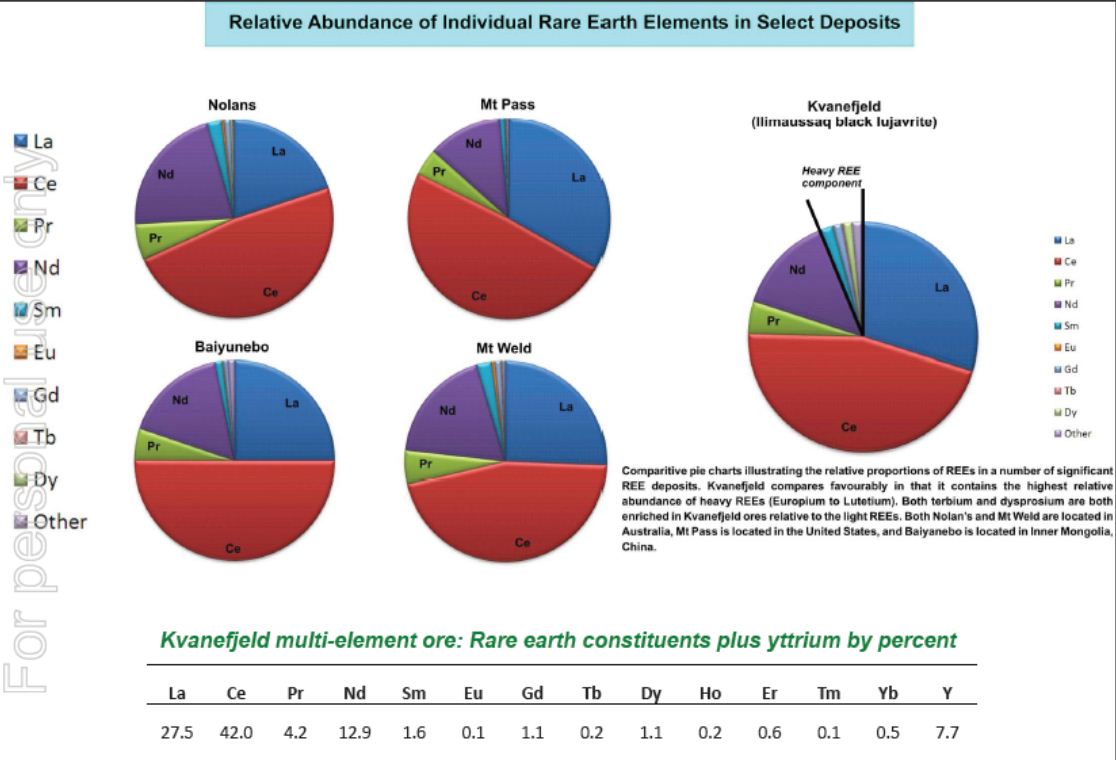

The image below (from Greenland Energy and Minerals latest company presentation) shows some interesting factors re investment.... in that the USA's Mountain Pass deposit is relatively deficient in the heavy REEs and has almost no samarium and very little H-REEs other than neodyium and praseodymium. Whereas the Nolans (ARU), Mt Weld (LYC), Kvanejeld (GGG) deposits are in relative terms well endowed. Although Alkane's (ALK) Dubbo Zirconium deposit isn't represented in the image below. it also has an interesting mix of H-REES.

Global Rare Earth Resources Ranked by Resource size of Heavy Rare Earth Oxides (HREO)

ASX codes highlighted (yellow). A recent update by Australia's Hastings Resources ASX: HAS

Alkane Resources DZP at Dubbo, NSW, Australia.

One of the world's richest (resource size) Heavy REE deposit.

Note the extremely high value for Yttrium that Alkane enjoys.

(Note that Lithium is the only metal that shifts from being non-critical to critical over the next decade.) Read about Australian Lithium at www.Australian-lithium.com

Investors should also note the supply position re the heavy REEs that ALK is likely to be in.

Many Rare Earths are difficult to substitute for:

Editor's note:

Persons that contribute to this page hold shares in ALK, GGG, LYC.

ASX listed REEs Companies with a (proven) JORC resource.

Russia also has large REE resources as outlined by a recent Reuters article. However the largest Russian deposit seems to mostly contain the light REEs.

Read about the Tomtor alkaline ultrabasic massif and related REE-NB deposits in northern Siberia

/>

/>